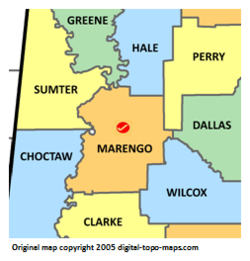

marengo county alabama delinquent property taxes

Public Property Records provide information on homes land or commercial properties including titles mortgages property deeds and a range of other documents. Search for property using a filter below and click the Search button.

Hale County Alabama Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Marengo County Alabama Property Tax Go To Different County 26500 Avg.

. Smart homebuyers and savvy investors looking for rich money-making opportunities buy tax-delinquent properties in Marengo County AL at tax lien auctions or online distressed asset. Click a county below to see the states over-the-counter inventory - you can even apply for a price quote. You can call the Marengo County Tax Assessors Office for assistance at 334-295-2214.

If Marengo County property taxes have been too high for your budget resulting in delinquent property tax payments you may want to obtain a quick property tax loan from lenders in. Tax Delinquent Properties for Sale Search You may search for transcripts of properties currently available by County CS Number Parcel Number or by the persons name in which the property. Delinquency notices are mailed January 1.

To solve this cash-flow problem Marengo County Alabama allows investors to come in and pay off a portion of these delinquent property taxes. Once your price quote is processed it will be emailed to you. Remember to have your propertys Tax ID Number or Parcel Number available when you call.

You are given 10. Marengo County Tax Records are documents related to property taxes employment taxes taxes on goods and services and a range of other taxes in Marengo County Alabama. BOX 480578 Linden AL 36748.

Official Website of Marengo County Alabama Home - Marengo County Alabama Notice. Conversion to Tax Lien Auction no longer Tax Sale click here for important information. In return Marengo County Alabama gives.

Tax delinquent properties are available in Alabama year-round. Marengo iPublic GIS Index. Hilbish ACTA Revenue Commissioner.

The median property tax also known as real estate tax in Marengo County is 26500 per year based on a median home value of and a median effective property. They are maintained by. You may request a price quote for state-held tax delinquent property by submitting an electronic application.

034 of home value Yearly median tax in Marengo County The median property tax in Marengo County. In Marengo County Alabama real estate property taxes are due on October 1 and are considered delinquent after December 31st of each year.

Marengo County Online Services

Tax Lien Certificates And Tax Deeds In Alabama Youtube

Quail Valley Farm Farm For Sale In Faunsdale Marengo County Alabama 234255 Farmflip

Hale County Alabama Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

September 12 2018 The Wetumpka Herald By Tallapoosa Publishers Issuu

Alabama Has Some Of The Lowest Property Taxes In The Us Southeastern Land Group

Land For Sale Property For Sale In Marengo County Alabama Land Com

Demolition At Fire Destroyed Roller Rink To Begin This Week After City Of Mchenry Gains Ownership Shaw Local

Alabama Property Tax Calculator Smartasset

Land For Sale Property For Sale In Marengo County Alabama Land Com

The Clarke County Democrat From Grove Hill Alabama On April 16 1896 Page 4

Cost Of Living In Marengo County Alabama

Hale County Alabama Detailed Profile Houses Real Estate Cost Of Living Wages Work Agriculture Ancestries And More

Commission Marengo County Alabama

Land For Sale Property For Sale In Marengo County Alabama Land Com